Service Offerings

The ABCs of Perfect Payroll Partners

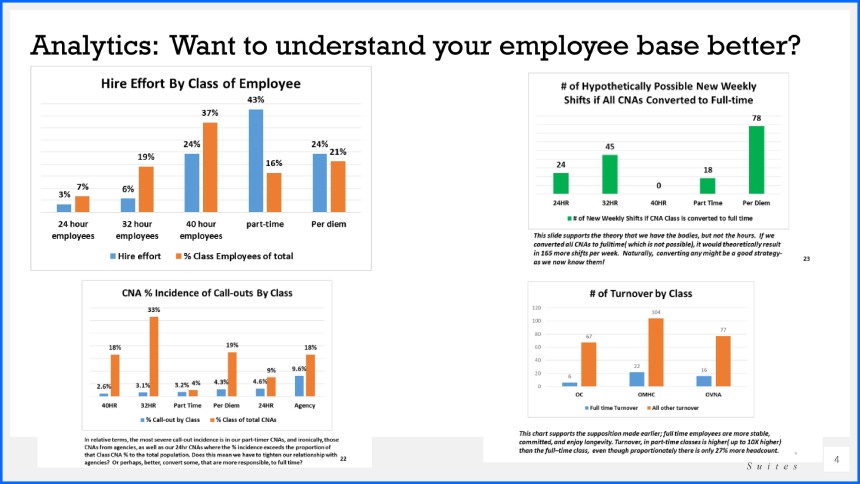

Analytics

Want to understand your employee base better?

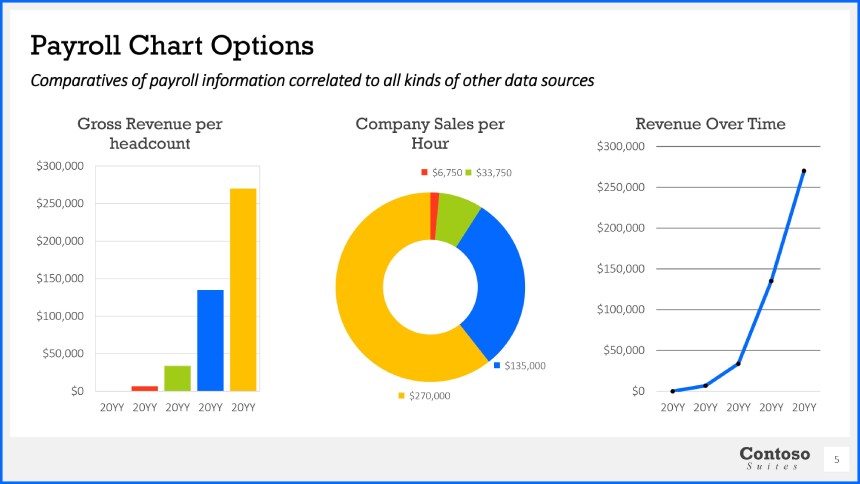

Payroll Chart Options

Comparatives of payroll information correlated to all kinds of other data sources

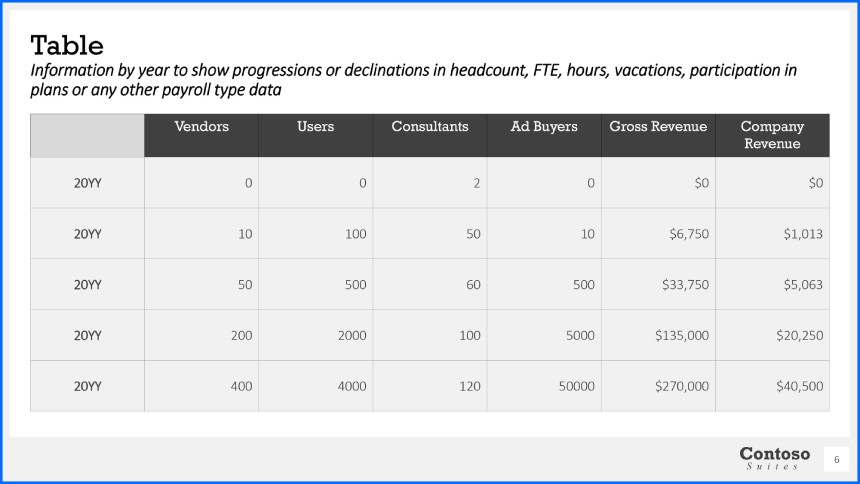

Table

Information by year to show progressions or declinations in headcount, FTE, hours, vacations, participation in plans, or any other payroll type data

Why Focus on Payroll?

As our country moves more towards service, it stands to reason that one of the largest costs in a company is wage and wage-related costs. Yet, we have not dedicated to payroll the leadership it necessarily needs and replaced management with the promise of outside payroll processor systems, which are very good but can easily get away from doing what they were originally intended to do.

Reevaluating Your Approach

You may have changed reps a couple of times, but the relationship keeps deteriorating. Chances are the processor's reps are powerless to help your payroll clerks, because of the contraptions that have been added onto the mechanisms in the system, and now it is beyond recognition. It’s not working as it was originally intended to and has been to point that they are somewhat stymied and unable to help other than offer a few possible solutions. We can help with that too, and that will put you back on track with your rep and improve your communication. With the system brought back to its original form, you can begin to work better together and you might just find the features you need at a very low cost compared to the traumatic removal, replacement of the existing provider's system, and the long arduous task of installing a new and very similar processor's system. So think about it deeply- do you really need to do that? Call Perfect Payroll Partners first, before making calls to a new provider.

Typical Review